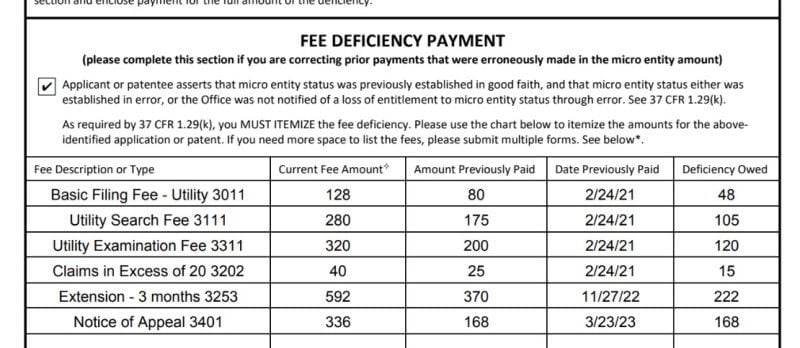

If you paid micro entity fees when you should have paid small entity fees, then your patent is in jeopardy. You must correct this by paying the difference to the USPTO as soon as possible. Let me explain how to easily identify these fee discrepancies, often the hardest part of filling in the Notice of Loss of Micro Entity Status (Form SB/460). Mistakes in entity status could go back years and you don’t want to scroll through all of the data. Fortunately, you can use the PTO codes to easily track down every instance of underpayment and pay the full amount owed.

Step-by-Step Process

Step 1: Obtain Form SB/460

Start by downloading Form SB/460 from the USPTO’s website. This form is required to notify the USPTO of a change in entity status and to disclose the fee adjustments.

Step 2: Identify Fee Transactions in Patent Center

- Access the Patent Center: Log into the USPTO’s Patent Center.

- Locate the Patent Application: Enter the patent application serial number to locate the specific application where fees were paid under the incorrect entity status. You can find your serial number on your filing receipt or an office action that you received from the Patent Office.

- Access Documents and Transaction:

- Click on Documents and Transactions on the left side.

- This tab provides a record of all documents and fee transactions associated with the application.

- Search for “WFEE” Transactions:

- Under the Doc code, look specifically for entries with the code “WFEE.” You can scroll down and read each Doc code. You can also press CTRL-F and type in wfee to search for this text on the screen.

- The “WFEE” entries represent fee payments. Each entry should list the date, fee type, and amount paid.

- Tip: Take note of each WFEE entry, as you’ll need to calculate the difference for each underpaid fee.

Step 3: Download all of the documents

- Click the check box on the right side of WFEE.

- Select download at the top of the page.

Step 3: Calculate Fee Differences

Scroll through the downloaded PDF. You will notice that there are fees paid. You’ll need to calculate the difference between the micro entity fee paid and the correct small or large entity fee:

- Note the Fee Type and Amount Paid:

- For each WFEE transaction, record the specific fee type (e.g., filing, maintenance) and the exact amount paid.

- Example: Suppose you see an entry for an extension of time, and the amount paid is $370.

- Look Up the Correct Fee from the Past Fee Schedule:

- Historical Fee Amount: Since the USPTO adjusts fees annually, the fee schedule might list a different fee than what was actually paid. Instead of relying on the current fee schedule, look up the exact amount paid on the date listed in the WFEE entry.

- Example: If the WFEE entry shows a 3 month extension of time as a micro entity on April 15, 2022, check the 2022 fee schedule to find what a small entity should have paid for that same maintenance fee.

- Go to the USPTO fee schedule. The USPTO does change the webpage of the fee schedule from time to time. As such, if the link doesn’t take you to the fee schedule, just go to google.com and search for USPTO fee schedule.

- Press CTRL-F to look for text on screen. Enter the Fee Code. In our example, that would be 3253. See image above.

- Calculate the Difference:

- Subtract the amount that was paid under the micro entity rate from the amount that should have been paid under the correct entity rate.

- Example: If the correct fee for a small entity was $592, and only $370 was paid as a micro entity, the difference owed is $222.

- Repeat for Each WFEE Entry:

- Perform these calculations for each WFEE entry in the Document History to capture all underpaid fees.

Step 4: Complete Form SB/460

Now that you have a list of fees paid and the differences owed:

- Enter Fee Details on Form SB/460:

- For each discrepancy, provide the type of fee originally paid, the micro entity amount paid, and the correct small (or large) entity fee.

- For each discrepancy, provide the type of fee originally paid, the micro entity amount paid, and the correct small (or large) entity fee.

- Summarize Total Fee Adjustment:

- At the end of the form, include the total amount owed for all discrepancies.

Step 5: Submit the Form and Pay the Deficiency

After completing Form SB/460, submit it with payment for the total fee deficiency. Ensure you follow the USPTO’s accepted payment methods to avoid delays.

Tips for Avoiding Future Issues

To prevent future issues with entity status, verify your entity status each time a fee is due. Here are the rules for determining your entity status.

Example and Resources

For additional guidance, you can refer to a sample filled-out Form SB/460 here: Filled Form SB/460 with Fee Adjustment. This example demonstrates the process of itemizing each fee and corresponding adjustment for accuracy.

By following these steps, you can efficiently identify and correct underpaid fees, helping to protect your patent from possible invalidation.

Should you need any help with the patent process, please schedule a consultation with me. Call (949) 433-0900.