By Dennis Crouch

The Federal Circuit has reversed a preliminary injunction order in a trade secret misappropriation case, finding that the district court abused its discretion by failing to properly evaluate the likelihood of success on the merits and the balance of harms. Insulet Corp. v. EOFlow, Co., No. 2024-1137 (Fed. Cir. June 17, 2024). The appellate court held that the district court’s analysis was deficient in several key respects, including not addressing the statute of limitations defense, defining trade secrets too broadly, and not sufficiently assessing irreparable harm and the public interest.

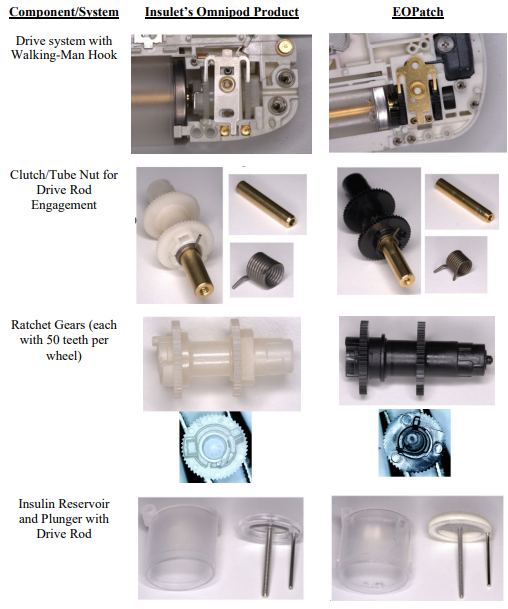

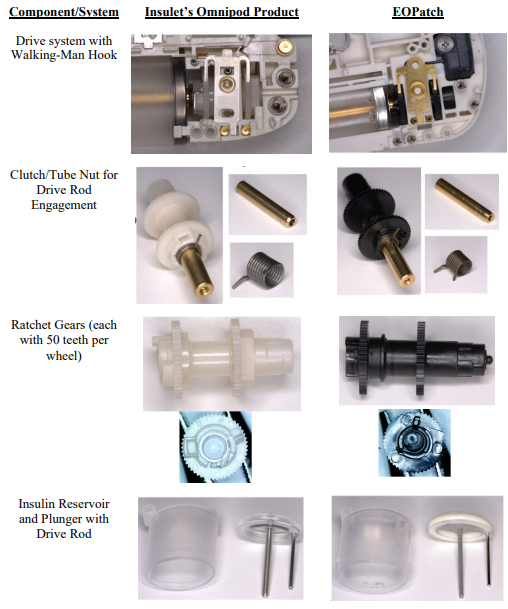

This classic trade secret case involves former employees left to join a competitor. As free humans, they are permitted to take their skill and wisdom to the new jobs, but are forbidden from misappropriating trade secret knowledge. That line drawing is particularly difficult, and one reason why many employers moved toward contractual non-compete agreements. The case is also complicated because the defendant here admit to reverse engineering that apparently lead to some substantial similarities between the products.

The decision highlights a high bar for obtaining a preliminary injunction, even in trade secret cases involving competitors where we previously may have assumed irreparable harm. The Federal Circuit here explained that lower courts are required to individually evaluate each of the four injunction factors – likelihood of success on the merits, irreparable harm, balance of hardships, and public interest. Conclusory assertions of competitive harm are insufficient to show irreparable injury. For trade secret claims in particular, the alleged trade secrets must be defined with specificity. But, this proof is often difficult at the preliminary injunction stage of a case when the particular knowledge used by the defendant has not been fully discovered.

The Federal Circuit has been seen as largely supporting strong trade secrecy rights. However, this decision may put a damper on forum shopping attempts.

Insulet and EOFlow are competitors in the wearable insulin pump market. Insulet sued EOFlow and several former Insulet employees in the District of Massachusetts, alleging trade secret misappropriation under the federal Defend Trade Secrets Act (DTSA), 18 U.S.C. § 1836. Insulet sought a preliminary injunction to prevent EOFlow from manufacturing or selling any products developed using Insulet’s trade secrets.

The district court granted the preliminary injunction, finding that Insulet was likely to succeed on the merits of its trade secret claim (at least in part). The court determined that there was strong evidence of misappropriation because EOFlow hired former Insulet employees who retained Insulet’s confidential documents. It also found that irreparable harm to Insulet would occur if EOFlow was acquired by Medtronic, a larger competitor. The Federal Circuit had jurisdiction over the appeal because the complaint also alleges patent infringement claims, and the Federal Circuit has exclusive appellate jurisdiction over appeals of cases that include a patent claim or compulsory-counterclaim even if the patent issue is not being appealed.

On appeal, the Federal Circuit held that the district court abused its discretion in several ways. As EOFlow’s attorney Adam Gershenson (Cooley) explained at oral arguments: “The district court’s vague, unsupported ruling contradicts Supreme Court precedent, the federal rules, and the Defense Trade Secrets Act.”

First, the court failed to address EOFlow’s argument that Insulet’s claims were barred by the DTSA’s three-year statute of limitations under 18 U.S.C. § 1836(d). As the appellate court explained, “if the three-year statute of limitations for filing a DTSA claim had expired, Insulet’s claims would be time-barred and therefore would have no chance of success.” Recognizing that trade secret claims are typically quite difficult to discover, Congress built a discovery rule into the statute of limitations with the three-year SOL being triggered by the date in which the misappropriation is discovered or should have been discovered based upon reasonable diligence. The parties are arguing before the district court about whether this time period has passed.

Second, the district court defined “trade secrets” too broadly, generally discussing “confidential information” rather than applying the statutory definition in 18 U.S.C. § 1839(3). The DTSA requires that the owner take reasonable measures to keep the information secret and that the information derive independent economic value from not being generally known or readily ascertainable through proper means. On this point, the plaintiff will need to identify the particular information that was misappropriated and show that it was trade secret information protected by the DTSA.

Third, the district court did not adequately assess whether the alleged trade secrets could have been (or were) obtained through reverse engineering of Insulet’s publicly available OmniPod device. “If information is ‘readily ascertainable through proper means’ such as reverse engineering, it is not eligible for trade secret protection.” (quoting Kewanee Oil Co. v. Bicron Corp., 416 U.S. 470 (1974)). The lower court also erred in not considering Insulet’s patent disclosures as another potential source of public knowledge about the OmniPod.

Fourth, the Federal Circuit found that the district court’s irreparable harm analysis was flawed. The alleged harm was based on a potential acquisition of EOFlow by Medtronic, not the use or disclosure of trade secrets. But “neither a generalized fear of a larger competitor nor any theoretical sale that can be remedied with damages constitutes a cognizable irreparable harm.” The court’s finding that Insulet would lose market share and face price competition was speculation that was unsupported by the evidentiary record. Further, Medtronic acquisition deal is apparently dead, rendering this justification for the preliminary injunction moot.

Finally, the Federal Circuit criticized the district court for only cursorily addressing the public interest factor, stating that it “s[aw] little impact one way or the other.” A more thorough analysis was required under Supreme Court precedent. See Winter v. NRDC, Inc., 555 U.S. 7, 26 (2008) (district court must meaningfully assess balance of equities and public interest).

The Federal Circuit emphasized that it was not deciding the ultimate merits of Insulet’s trade secret claims, only that Insulet had not established a likelihood of success and the other preliminary injunction factors based on the current record. The case now returns to the district court for further proceedings.